The Adani Group, one of India’s largest conglomerates, is under scrutiny following allegations of a $250 million bribery scheme. Reports suggest that Gautam Adani, along with senior associates, including his nephew, allegedly facilitated payments to Indian government officials to secure favorable terms for solar power contracts between 2020 and 2024. These accusations have reignited global concerns about corporate governance within the group, causing significant turmoil in financial markets.

The Allegations

The U.S.-based lawsuit claims that the funds were routed through offshore entities to influence regulatory and policy decisions related to renewable energy projects in India. This marks the latest in a series of controversies involving the Adani Group, coming on the heels of the Hindenburg Research report earlier this year, which accused the conglomerate of stock manipulation and fraud.

Market Reaction

The allegations have had immediate financial repercussions. Adani Group stocks, including Adani Enterprises and Adani Energy Solutions, witnessed a sharp decline, plummeting up to 20% on major stock exchanges. The group also withdrew a $600 million bond offering, signaling potential liquidity concerns. Analysts suggest that this development could further dent investor confidence, particularly among international stakeholders, who have already been wary following the Hindenburg revelations.

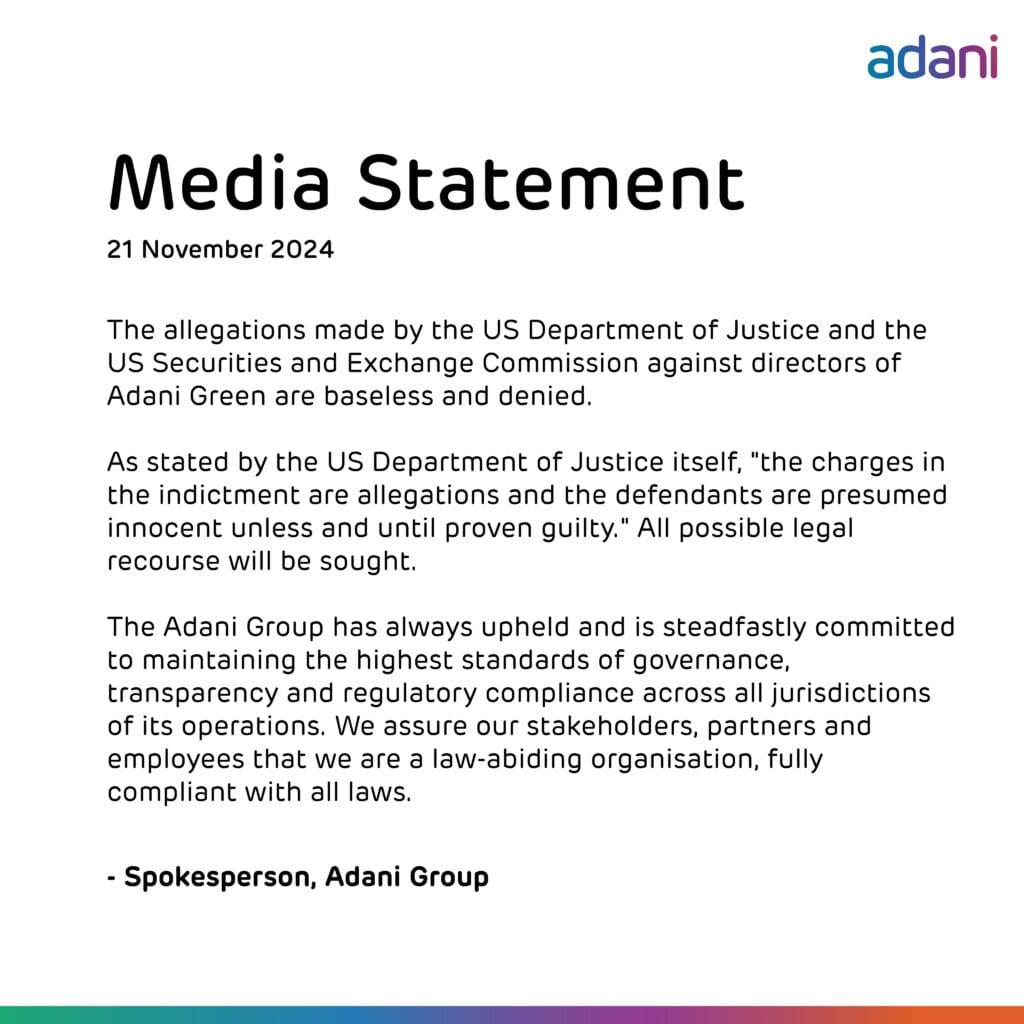

Adani Group’s Response

The Adani Group has categorically denied the allegations, describing them as “baseless and politically motivated.” In an official statement, the company asserted its adherence to ethical business practices and expressed confidence in its legal defense. The group framed the accusations as part of a broader attempt to undermine India’s economic growth and its role in the global renewable energy sector.

Political and Economic Implications

This case has sparked a heated debate in India, with opposition parties using it to criticize the government’s perceived close ties with the Adani Group. The allegations also come at a sensitive time, as India prepares for its 2024 general elections, with corruption and crony capitalism likely to become central campaign issues.

On the international stage, the case could impact India’s credibility in attracting foreign investments, especially in the renewable energy sector, which is critical to its climate goals. Experts warn that such high-profile allegations might deter global investors wary of governance risks in emerging markets.

As the Adani Group prepares for legal challenges, the allegations underscore the ongoing scrutiny of corporate practices in India’s private sector. While the group’s official denial aims to reassure stakeholders, the unfolding legal and financial developments will likely shape its reputation and investor confidence in the months ahead.

This controversy highlights the broader implications of governance and transparency in India’s quest to become a global economic powerhouse. Whether the Adani Group can weather this storm remains to be seen, but the case will undoubtedly serve as a litmus test for accountability in India’s corporate landscape.